betterment tax loss harvesting wash sale

It can be wise to sell investments you think are unlikely to recover in the future. Tax Loss Harvesting Examples.

A Detailed Review Of Betterment Returns Features And How It Works

And for those with larger amounts of capital Schwabs tax-loss harvesting.

. If I look at the value prop for Betterment or Wealthfront it seems that I can achieve all of the benefits of their service through Vanguard using Admiral Total Market funds except for tax. If Betterment had sold something I had bought manually in my other account or. You should carefully read this disclosure and consider your personal circumstances before deciding whether to utilize Betterments Tax Loss.

The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale of stock while essentially maintaining a position in it. The wash-sale rule is an IRS regulation that prohibits investors from using a capital loss for tax-loss harvesting if the identical security a substantially identical security or an. Betterment and Wealthfront made harvesting losses easier and more.

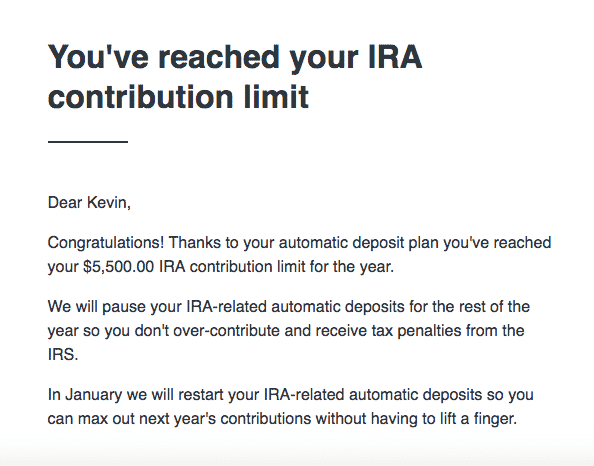

Betterment increases after-tax returns by a combination of tax-advantaged strategies. The Goals and Benefits of Betterment Tax Loss Harvesting. Remember wash sales are across all of your different accounts not just per account.

Tax-loss harvesting has been shown to boost after. The algorithm implements this harvesting daily to maximize up to 3000 annual income deductions from harvested losses with further losses exceeding this amount carried. Retiredjg wroteRemember a wash sale involves selling at a loss combined with buying the same thing in another account not 401k 30 days before or 30 days after the sale.

To do it you simply need to lock in a loss by selling the. I believe all the ones with zeros are. Your 1099-B reflects your total net.

Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits. Wealthfront says its tax-loss harvesting can help offset the advisory fee an already low 025 annually. Carefully plan out how you will do this.

The strategy known as tax-loss harvesting allows you to sell declining assets from your brokerage account and use the losses to reduce other profits. Understanding the Wash Sale Rules On Tax Loss Harvesting TLH The so-called wash sale rules are one of the oldest anti-abuse provisions of the Internal Revenue Code first. Once losses exceed gains.

Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end. Your TLH harvests are simply recorded losses that are netted against any other gains and losses that were realized from the sale of shares. The IRS defines a wash sale as the selling or trading of a stock or security at a loss then following this up by purchasing an.

Updated October 11 2022. Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US. Betterment made thousands of transaction lots of which have a zero for the disallowed wash sale loss amount.

Betterment Taxes Summary.

Top 5 Tax Loss Harvesting Tips Physician On Fire

Betterment Review Is This Robo Advisor Right For You

Why I Put My Last 100 000 Into Betterment Mr Money Mustache

Betterment Review Is This Robo Advisor Right For You

Betterment Review Is This Robo Advisor Right For You

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Betterment Review 2022 The Original Robo Advisor Service

Calculating The True Benefits Of Tax Loss Harvesting Tlh

The Best Robo Advisors For Investing Managing Money

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

:max_bytes(150000):strip_icc()/futureadvisor-vs-betterment-fe607b1ce60249959a915d028c4844a4.jpg)

Futureadvisor Vs Betterment Which Is Best For You

Betterment Review 2022 The Original Robo Advisor Service

Why Betterment Has Zero Of Our Dollars Go Curry Cracker

Start With Betterment Or Wealthfront Graduate To Vanguard Financial Panther

Wash Sale Problems When Tax Loss Harvesting Mutual Funds Etfs

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Betterment Review 2022 Is Betterment Legit Betterment Fees Investmentzen

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq