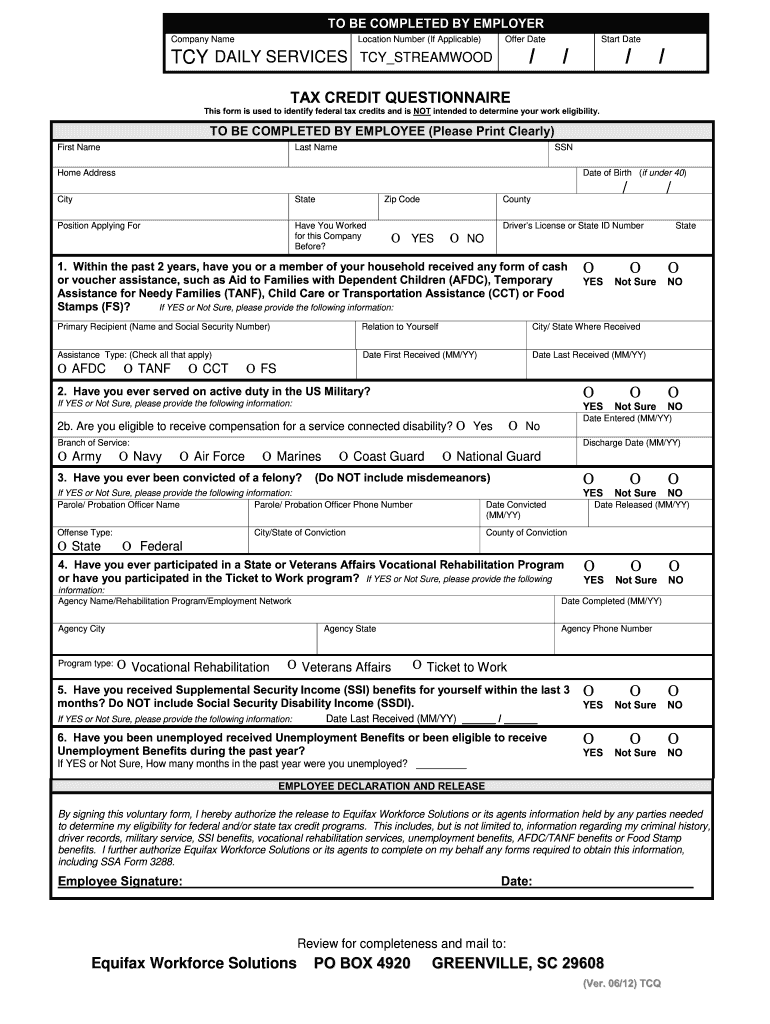

work opportunity tax credit questionnaire form

IRS Form 8850 PreScreening Notice and Certification Request for the Work Opportunity Tax. The WOTC is a federal tax credit available to employers who invest in American job seekers who.

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

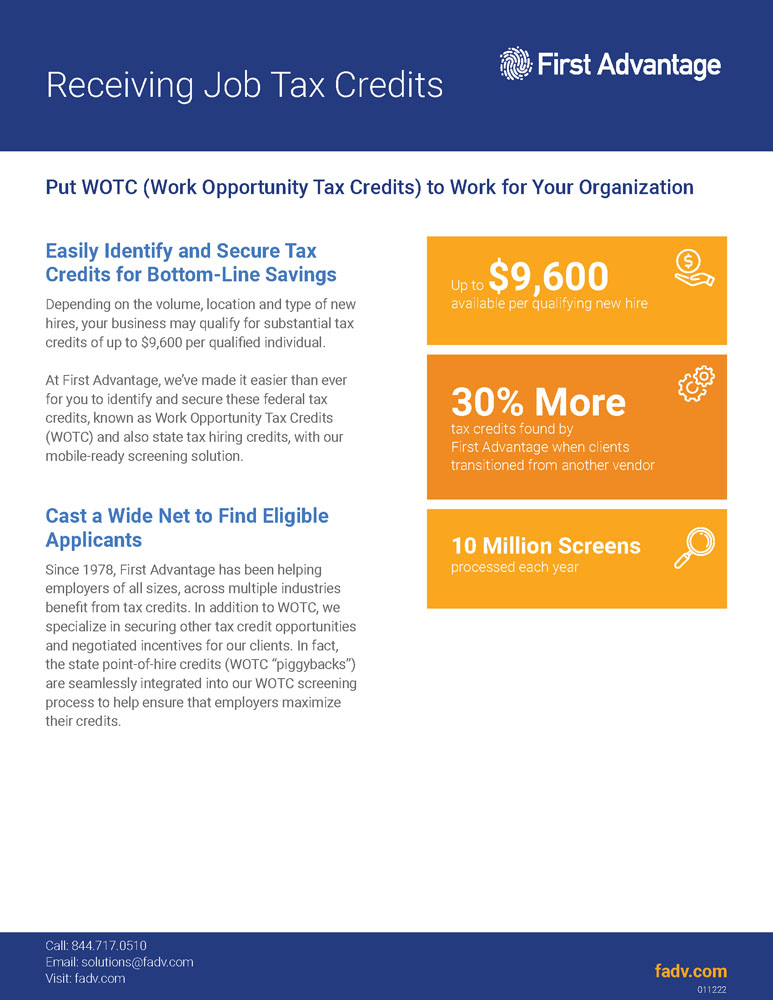

Through the Work Opportunity Tax Credit WOTC Program employers have the opportunity to earn a federal tax credit between 1200 and 9600 per employee.

. AlwaysOn Reporting Our advanced platform delivers an array of real-time reporting that encompasses all critical metrics. Average certification value by. If so you will need to complete the questionnaire when you.

The program has been designed to promote the. 501c tax exempt organizations use IRS form 5884-C. You may complete and.

The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. The credit is 25 of qualified first-year wages for those employed at least 120 hours but fewer than 400 hours and 40 for those employed 400 hours or more.

What is the Work Opportunity Tax Credit. To claim the tax credit when filing your federal business tax return use IRS form 5884. Completing Your WOTC Questionnaire.

Completing Your WOTC Questionnaire. Get and Sign Wotc Questionnaire 2012-2022 Form Use a wotc form 2012 template to make your document workflow more streamlined. Qualifying Groups For the employer to claim the.

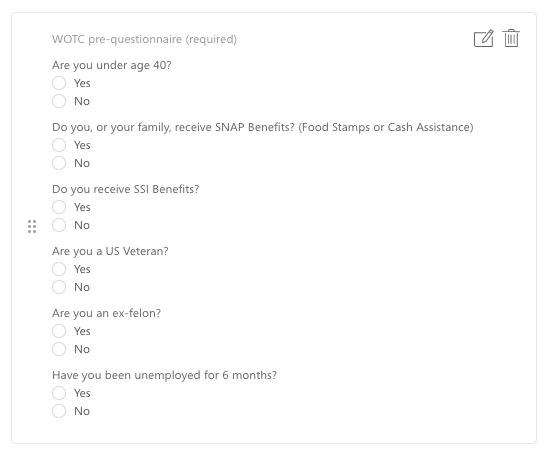

Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. This is how much our WOTC management tool could help you save annually.

Information about Form 5884 Work Opportunity Credit including recent updates related forms and instructions on how to file. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. Work opportunity tax credit 2020.

Compass Group is participating in the Work Opportunity Tax Credit WOTC program. Comply with our simple steps to. 1 Legal Form library PDF editor e-sign platform form builder solution in a single app.

Is participating in the WOTC program offered by the government. New hires may be asked to complete the. ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form.

The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups. The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers. The answers are not supposed to give preference to applicants.

ABC COMPANY participates in the federal governments Work Opportunity Tax Credit Welfare to Work and other federal and. Now creating a Wotc Questionnaire requires at most 5 minutes. When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training.

The job seeker or the employer must complete the Individual Characteristics Form Work Opportunity Tax Credit ETA 9061. The employer and the job seeker must complete the. Certifications to employers seeking a Work Opportunity Tax Credit WOTC.

Employers file Form 5884 to claim the work opportunity credit for qualified 1st- or 2nd-year wages paid to or incurred for targeted group employees during the. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Our state online blanks and complete recommendations eliminate human-prone mistakes.

Average percent certified by industry is based on 2016 Equifax data. If so you will need to complete the questionnaire when you. WOTC powered by technology that always keeps you in-the-know.

ETA Form 9062 Conditional Certification. January 2012 Department of the Treasury Internal Revenue Service Pre-Screening Notice and Certification Request for the Work Opportunity Credit a See separate. This program is designed by the federal government to help companies hire more people into the.

April 27 2022 by Erin Forst EA. ETA Form 9061 Individual Characteristics Form.

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Questionnaire Fill And Sign Printable Template Online Us Legal Forms

Work Opportunity Tax Credit What Is Wotc Adp

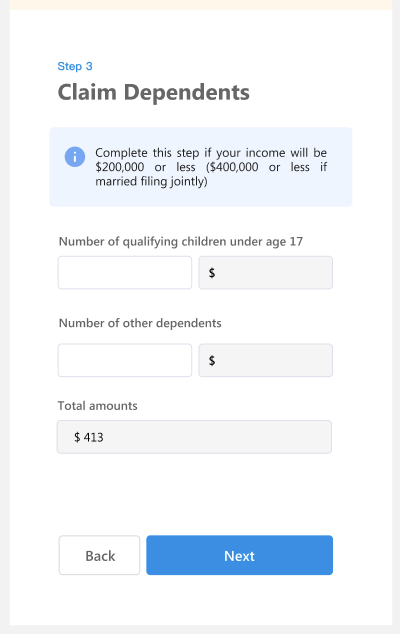

New W4 Form Wotc Screening Features Product Updates

Completing Your Wotc Questionnaire

Completing Your Wotc Questionnaire

Work Opportunity Tax Credit First Advantage

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

With Wotc Timing Is Everything Wotc Planet

Work Opportunity Tax Credit What Is Wotc Adp

New W4 Form Wotc Screening Features Product Updates

Wotc Savings For Employers Cost Management Services Work Opportunity Tax Credits Experts