wichita ks sales tax rate 2020

679 rows 2022 List of Kansas Local Sales Tax Rates. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick.

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

The kansas state sales tax rate is currently.

. Wichita County in Kansas has a tax rate of 85 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Wichita County totaling 2. The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county sales. Lower sales tax than 74 of Kansas localities.

What is the sales tax rate in Wichita County. The kansas state sales tax rate is currently. 2020 rates included for use while preparing your income tax deduction.

This rate includes any state county city and local sales taxes. Average Sales Tax With Local. You can print a 75 sales tax.

The average cumulative sales tax rate between all of them is 85. Wichita collects the maximum legal local sales tax. Wichita collects the maximum legal local sales tax.

This is the total of state county and city sales tax rates. These are for taxes levied by the. The sales tax rate.

These are for taxes levied by the. This rate is the sum of the state county and city tax rates outlined below. The latest sales tax rate for Wichita County KS.

The minimum combined 2022 sales tax rate for Wichita County Kansas is. In 1994 the City of Wichita mill levy rate the rate at which real and personal property is taxed was 31290. Rates include state county and city taxes.

2020 rates included for use while preparing your income tax deduction. What is the sales tax rate in North Wichita Kansas. What is the sales tax rate in Wichita Kansas.

The most populous location in Wichita County Kansas is Leoti. You can find more tax rates. In 1994 the City of Wichita mill levy rate the rate at which real and personal property is taxed was 31290.

Kansas KS Sales Tax. The City of Wichita property tax mill levy rose slightly for 2020. There is no applicable city tax or special tax.

Wichita is budgeting a 55 million property tax increase The. The minimum combined 2022 sales tax rate for North Wichita Kansas is. This is the total of state and county sales tax rates.

Lowest sales tax 55 Highest sales tax 115 Kansas Sales Tax. This is the total of state county and city sales tax rates. This rate is the sum of the state county and city tax rates outlined below.

A full list of these can be found below. The minimum combined 2022 sales tax rate for Wichita Kansas is. Kansas corporate tax rate is 700 400 of Kansas taxable net income plus 300 surtax 2011 on taxable net income in excess of 50000.

The kansas state sales tax rate is currently. This rate is the sum of the state county and city tax rates outlined below. Wichita Ks Sales Tax Rate 2020.

Sales Tax Calculator Sales Tax Table. Only the proportion of net. Wichita Ks Sales Tax Rate 2020.

3 lower than the maximum sales tax in KS. The City of Wichita property tax mill levy rose slightly for 2021. 750 Is this data incorrect The Sumner County Kansas sales tax is 750 consisting of 650 Kansas state sales tax and 100 Sumner County local sales taxesThe local sales tax.

Wichita is budgeting a 55 million property tax increase The. The 75 sales tax rate in Wichita consists of 65 Puerto Rico state sales tax and 1 Sedgwick County sales tax.

Wichita Property Tax Rate Up Just A Little

Institute For Policy Social Research

Wichita Kansas Ks Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Institute For Policy Social Research

Kansas Department Of Revenue Selected Kansas Tax Rates With Statutory Citation

Kansas Sales Tax Calculator And Local Rates 2021 Wise

Texas Sales Tax Rates By County

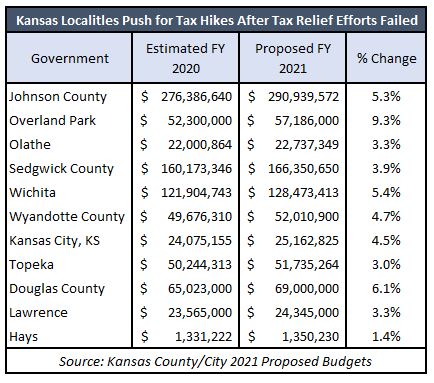

Kansas Counties And Cities Hike Taxes Amidst Covid Recession Kansas Policy Institute

Schmidt Kelly Ring Up Intriguing Campaign Narratives About Kansas Sales Tax Rate Kansas Reflector

Kansas Department Of Revenue Selected Kansas Tax Rates With Statutory Citation

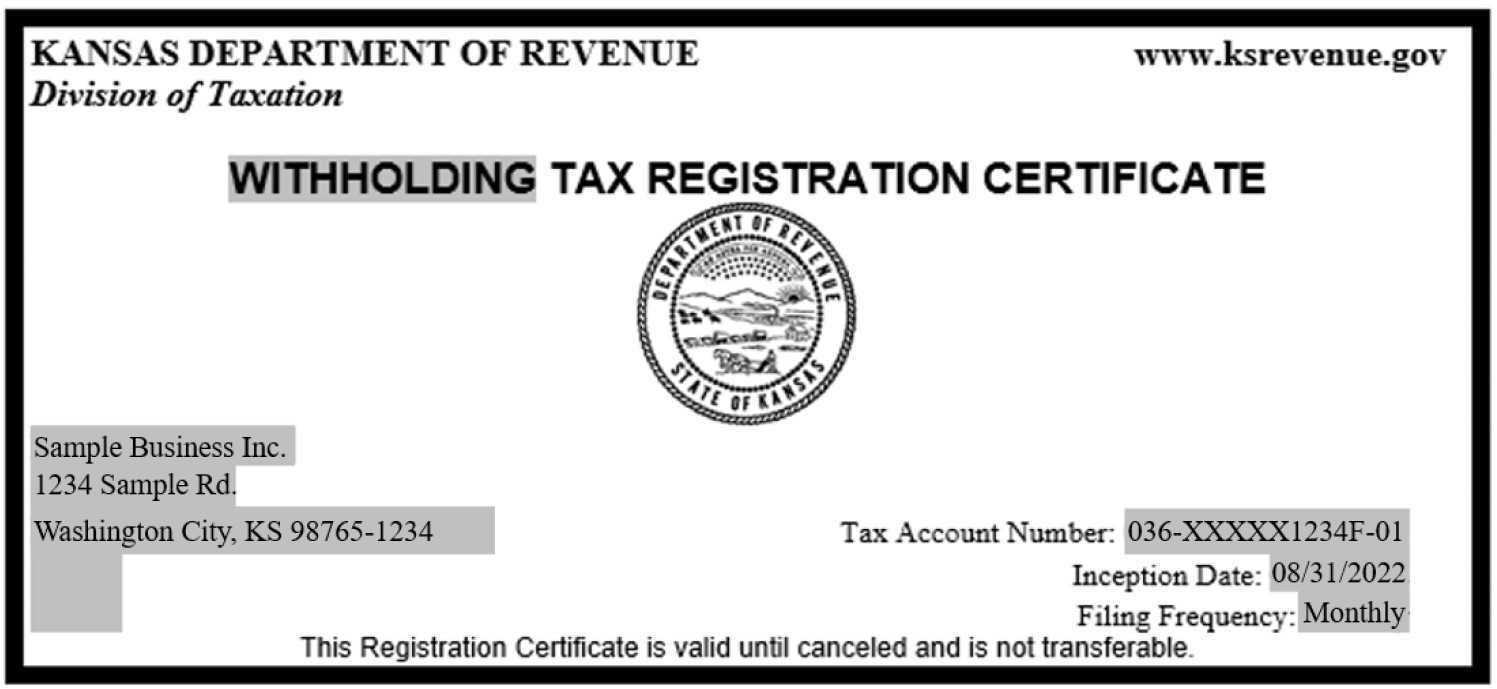

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Kansas Department Of Revenue Selected Kansas Tax Rates With Statutory Citation

Kansas Income Tax Calculator Smartasset

Register Of Deeds Sedgwick County Kansas

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Reducing Food Sales Tax Benefits Latino Communities Kansas Governor Says Kansas Reflector

Wichita Property Tax Rate Up Just A Little

Kansas Governor Plans To Axe Sales Tax On Food Joins Ag In Urging Legislative Action Kansas Reflector

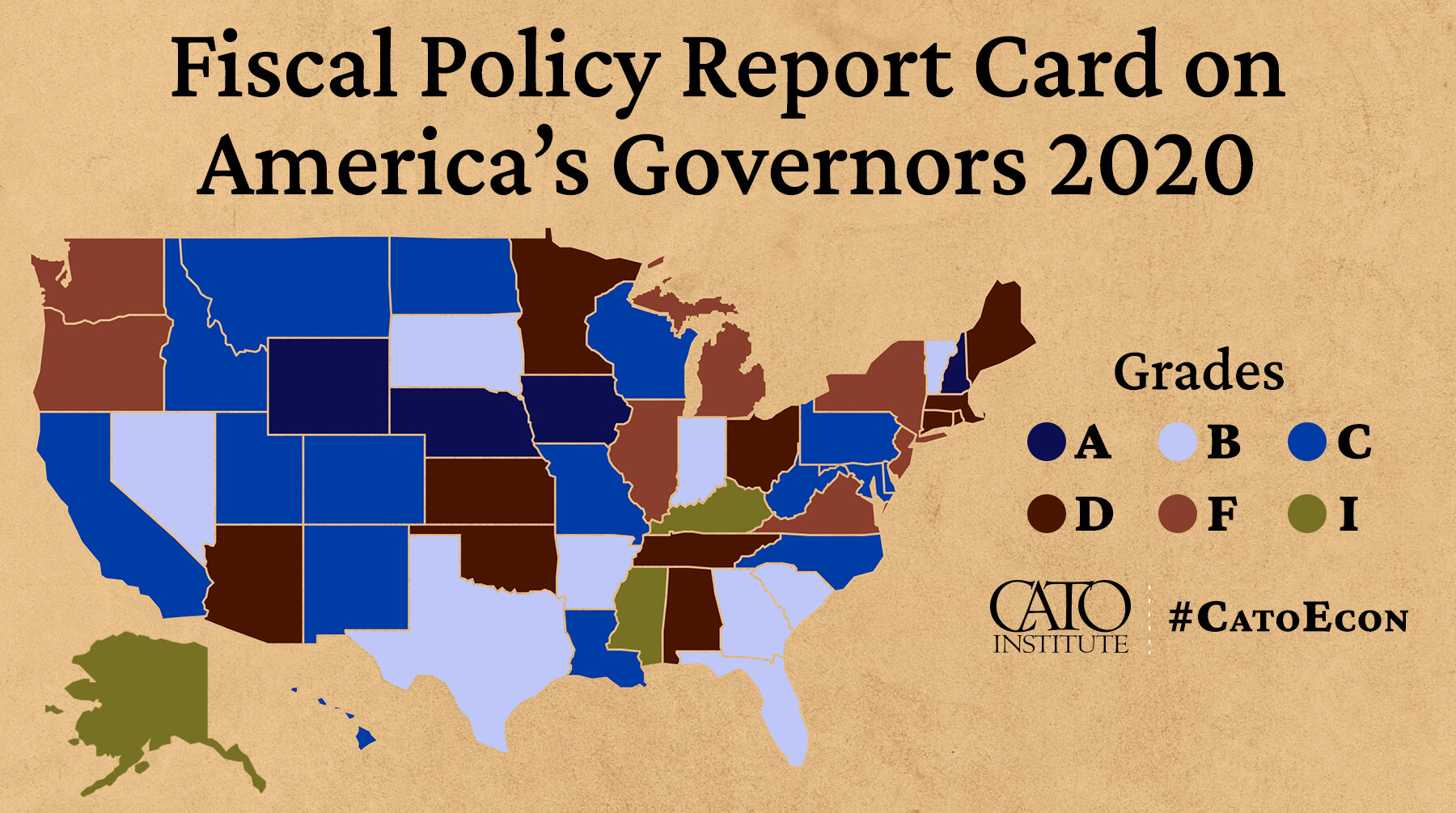

Fiscal Policy Report Card On America S Governors 2020 Cato Institute